Real Estate Tax Appeals Introduce

For homeowners and businesses across Illinois, property taxes can be a significant and often confusing expense. It’s a common concern that your property’s assessed value may be too high, leading to an unfair tax burden. This is where a specialized legal expert can make a world of difference. This article provides an in-depth look at Real Estate Tax Appeals, a professional real estate attorney dedicated to helping Illinois residents navigate the complex world of property tax assessments. From reducing your annual tax bill to obtaining refunds for missed exemptions, this firm offers a focused and valuable service to the community.

Real Estate Tax Appeals operates as a specialized Real Estate Attorney, with a singular focus on property tax matters. Unlike firms that handle a broad range of real estate issues, this attorney has honed their expertise in one crucial area: ensuring their clients are not overpaying on their property taxes. The firm’s name itself clarifies its primary purpose. This specialization is a major advantage, as it means their knowledge and experience are concentrated on the specific nuances and procedural intricacies of the Illinois property tax system. They are well-versed in the processes for different counties, including Cook County, which is known for its complex assessment procedures.

The firm’s mission is to act as a crucial advocate for property owners. They understand that every dollar saved on property taxes can make a real difference in a family or business budget. By focusing on assessment appeals, they provide a direct and impactful service. This overview will explore the specific services they offer, the practical features of their office, and why their specialized approach makes them a worthwhile partner for anyone in the Illinois region looking to reduce their tax burden.

Real Estate Tax Appeals is conveniently located at 9213 Burlington Ave in Brookfield, IL 60513, USA. This location places the firm in a key suburban area of Illinois, making it easily accessible for clients throughout the western suburbs of Chicago and beyond. A local presence is crucial when dealing with local tax authorities, as it implies a deep understanding of the specific rules and procedures of the region.

The firm is also committed to ensuring their physical office is accessible to all. The premises feature a wheelchair accessible entrance, a wheelchair accessible parking lot, and a wheelchair accessible restroom. This thoughtful design ensures that every client can access the legal assistance they need in a comfortable and accommodating environment. While appointments are not mentioned as required, calling ahead is always recommended to ensure that a professional is available to give your case the undivided attention it deserves.

Real Estate Tax Appeals provides a highly specialized suite of services designed to help property owners reduce their tax bills and correct errors in their assessments. Their focus on this niche area means they have an in-depth understanding of the laws and processes involved.

Here is a list of their primary services:

- Reduce taxes if you are paying more than your neighbors: A core service is helping clients lower their property taxes by appealing an over-assessment. The firm analyzes a property's value in comparison to similar homes in the neighborhood to determine if the assessment is unfair. This is a common and effective way to get a tax reduction.

- Obtain Refunds for missing exemptions: Many homeowners may be eligible for various exemptions, such as the Homeowner Exemption or Senior Citizen Exemption, which can significantly lower their tax bill. Real Estate Tax Appeals helps clients apply for these exemptions and can even assist in obtaining refunds for years where these exemptions were not applied.

- Fire, Wind Other Catastrophe: This service is for property owners who have experienced a disaster that has significantly damaged their property. The firm can help clients appeal their property’s assessment to reflect its reduced value after a major catastrophe like a fire or wind damage, ensuring they are not taxed on a property that no longer has its pre-disaster value.

- Gut/Major Rehabilitation Property Vacant: If a property is undergoing a major rehabilitation and is left vacant, its value may be temporarily reduced. The firm assists clients in appealing their assessment to reflect the property's vacant status and reduced value during the construction period, leading to a temporary tax reduction.

While information is limited, the primary features of Real Estate Tax Appeals can be inferred from their specialization and commitment to accessibility. These qualities demonstrate their professional approach and dedication to client service.

- Highly Specialized Expertise: The most prominent feature of this firm is its focused practice. By concentrating solely on real estate tax appeals, they have a deep, practical knowledge of the legal and administrative processes. This specialization provides clients with a higher degree of confidence that their case is in expert hands.

- Service-Oriented Approach: The services offered, such as obtaining refunds for missing exemptions and assisting with appeals after a disaster, show a focus on providing tangible, financial benefits to clients. This demonstrates a clear commitment to helping people save money.

- Physical Accessibility: The firm’s commitment to providing a wheelchair accessible entrance, parking lot, and restroom highlights their dedication to inclusivity and their desire to serve all members of the Illinois community. This makes seeking legal help a less daunting experience for individuals with mobility challenges.

- Practical Solutions: The services they offer address common, real-world problems that homeowners and property owners face. Whether it’s an over-assessment or a damaged property, the firm provides practical and effective legal solutions that directly impact their clients' finances.

To get in touch with Real Estate Tax Appeals and learn more about how they can help you with your property tax situation, you can use the following contact information.

Address: 9213 Burlington Ave, Brookfield, IL 60513, USA

Phone: (708) 308-1883

Mobile Phone: +1 708-308-1883

You can reach out by phone to discuss your property tax concerns and find out how they can assist you.

When you are looking to challenge your property taxes, you need an attorney who is not just a general legal practitioner, but a specialist in this specific area. This is precisely what makes Real Estate Tax Appeals a strong choice for residents of Illinois. Their entire practice is built around helping people like you save money on their tax bills. The services they offer directly address the most common reasons for property tax overpayments, from an unfair assessment compared to neighbors to a property’s reduced value after a catastrophe.

A key advantage is their localized expertise. Being based in Brookfield, they are intimately familiar with the tax laws and procedures of the surrounding counties, which can differ significantly from one area to another. This local knowledge is invaluable in a field where deadlines and specific filing requirements are critical. Their focus on helping clients obtain refunds for missing exemptions is a particularly valuable service that can recover money that has already been overpaid. This proactive and detail-oriented approach provides a clear return on your investment in their services. For anyone in the Illinois region who suspects they are paying too much in property taxes, a consultation with Real Estate Tax Appeals is a logical and worthwhile first step. They offer a simple, clear, and effective path to financial relief.

Real Estate Tax Appeals Services

Real Estate Attorney

- Fire, Wind Other Catastrophe

reduce assessment to land value plus 10% for building can be more than one year

- Gut/Major Rehabilitation Property Vacant

reduce assessment to land value plus 10% for building

- Obtain Refunds for missing exemptions

Can get refunds back to 2014 for unclaimed Homeowner, Senior and Senior Freeze exemptions

- Reduce taxes if you are paying more than your neighbors

Research properties that are not being tax uniformly

Real Estate Tax Appeals Details

Accessibility

- Wheelchair accessible entrance

- Wheelchair accessible parking lot

- Wheelchair accessible restroom

Amenities

- Restroom

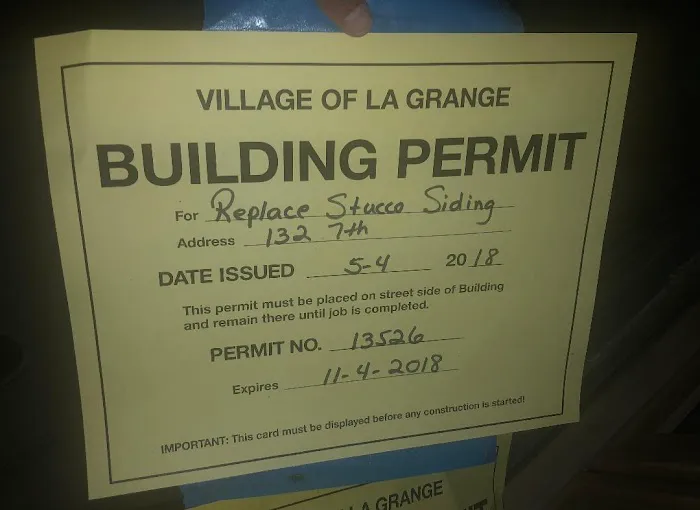

Real Estate Tax Appeals Photos

Real Estate Tax Appeals Location

Real Estate Tax Appeals

9213 Burlington Ave, Brookfield, IL 60513, USA

Real Estate Tax Appeals Reviews

More law offices near me

The Law Offices of Carlos H. Davalos5.0 (3 reviews)

The Law Offices of Carlos H. Davalos5.0 (3 reviews)7667 W 95th St Suite 203, Hickory Hills, IL 60457, USA

Elmosa & Associates Law Office2.0 (27 reviews)

Elmosa & Associates Law Office2.0 (27 reviews)11140 S Harlem Ave, Worth, IL 60482, USA

Ibrahim Law Global4.0 (131 reviews)

Ibrahim Law Global4.0 (131 reviews)7667 W 95th St #101, Hickory Hills, IL 60457, USA

Skinner Law Firm, P.C.5.0 (97 reviews)

Skinner Law Firm, P.C.5.0 (97 reviews)7548 W 103rd St, Bridgeview, IL 60455, USA

O'Keefe, Rivera & Berk, LLC4.0 (35 reviews)

O'Keefe, Rivera & Berk, LLC4.0 (35 reviews)5620 95th St, Oak Lawn, IL 60453, USA

James K. Kenny Attorney at Law5.0 (2 reviews)

James K. Kenny Attorney at Law5.0 (2 reviews)9759 SW Hwy, Oak Lawn, IL 60453, USA

Law Office of Jonathan W. Cole3.0 (11 reviews)

Law Office of Jonathan W. Cole3.0 (11 reviews)5013 95th St, Oak Lawn, IL 60453, USA

Edwin L Feld & Associates, LLC5.0 (3 reviews)

Edwin L Feld & Associates, LLC5.0 (3 reviews)5003 95th St, Oak Lawn, IL 60453, USA

Rouhy J. Shalabi & Associates5.0 (12 reviews)

Rouhy J. Shalabi & Associates5.0 (12 reviews)4700 W 95th St Suite LL-7, Oak Lawn, IL 60453, USA

Nawal M. Abueid Law Office5.0 (11 reviews)

Nawal M. Abueid Law Office5.0 (11 reviews)6854 W 111th St, Worth, IL 60482, USA

True Lawyer - Evergreen Park0.0 (0 reviews)

True Lawyer - Evergreen Park0.0 (0 reviews)9500 S Avers Ave Suite 7, Evergreen Park, IL 60805, USA

Geraci Law Llc4.0 (26 reviews)

Geraci Law Llc4.0 (26 reviews)3640 W 95th St, Evergreen Park, IL 60805, USA

Categories

Top Visited Sites

Raynes & Lawn4.0 (13 reviews)

Raynes & Lawn4.0 (13 reviews) Anderson Leavitt LLC5.0 (8 reviews)

Anderson Leavitt LLC5.0 (8 reviews) The Law Offices of Joseph A. Guillama4.0 (74 reviews)

The Law Offices of Joseph A. Guillama4.0 (74 reviews) North Star Legal Services, LLC5.0 (8 reviews)

North Star Legal Services, LLC5.0 (8 reviews) Eddins Domine Law Group PLLC4.0 (107 reviews)

Eddins Domine Law Group PLLC4.0 (107 reviews) Levine & Blit, PLLC4.0 (43 reviews)

Levine & Blit, PLLC4.0 (43 reviews)Trending Law Made Simple Posts

Law Made Simple: Understanding Child Custody Laws in Simple Terms

Law Made Simple: Understanding Child Custody Laws in Simple Terms How to Expunge a Criminal Record – A Complete Guide

How to Expunge a Criminal Record – A Complete Guide How to Avoid Common Legal Mistakes When Buying a Home – Expert Advice

How to Avoid Common Legal Mistakes When Buying a Home – Expert Advice Your Rights During a Police Stop – Essential Guide to Stay Safe and Protected

Your Rights During a Police Stop – Essential Guide to Stay Safe and Protected Your Rights During a Police Stop – Expert Legal Advice for Citizens

Your Rights During a Police Stop – Expert Legal Advice for Citizens How to Avoid Common Legal Mistakes When Buying a Home: What You Need to Know in 2025

How to Avoid Common Legal Mistakes When Buying a Home: What You Need to Know in 2025